Regardless of having a legion of experienced administrators at your disposal to safeguard the compliancy of your company with Philippine regulations, if there is a slight nick in your payroll resources and practices, what you long strived to protect—reputation and company records–will crumble.

For that reason, many employers are crossing their fingers that their payroll was processed flawlessly. Most importantly, free of compliance issues that could be brought about by the recent changes in the withholding tax calculations due to the TRAIN 2018-2022 Tax Reforms.

While it seems that adapting to the TRAIN changes is an unnerving experiencing, there really is nothing to it as long as you get the know-how on how to adjust….After all, knowledge slays fear. Below are some tips on how to cope regardless of how you do payroll:

Manual Process

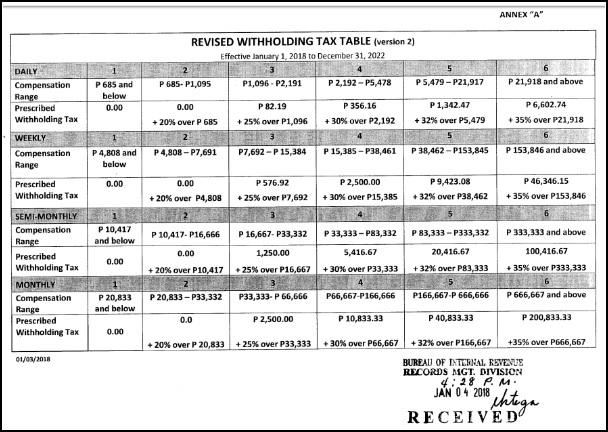

When it comes to manually computing payroll, the formula being used is only as good as the numbers inputted. Though the payroll process remains the same under the reforms brought by the 2018 TRAIN, what changes are the figures on the withholding tax table and how to use it.

As prescribed by the Bureau of Internal Revenue (BIR), payroll administrators should use the Revised Withholding Tax Table (Version 2).

Source: BIR

Here is how to use the TRAIN 2018 revised withholding tax table:

Step 1: Determine the payroll frequency that applies to the employee:

- Daily – Paid per day

- Weekly – Paid on a per week basis

- Semi-Monthly – Paid every 15 days or twice in a month

- Monthly – Paid on a per month basis or every 30 days

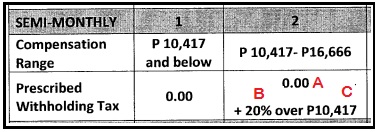

Step 2: Using the Revised Tax Table, choose which column (1 – 6) where compensation range of the employee falls under.

Step 3: Use the prescribed withholding tax that applies to the pay frequency and compensation range option.

Step 4: Use the (A) predetermined tax and then add that to (B) percentage of the amount that is excess to the total compensation over the (C) minimum compensation range.

2018 Withholding Tax Calculation Sample

Background info:

Taxable Income: P15,500

Pay Frequency: Semi-Monthly

Step 1: Determine the Pay Frequency

- -Using the background info, the pay frequency is set to Semi-Monthly

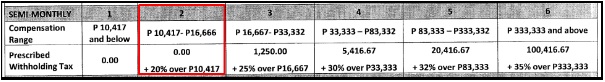

Step 2: Determine which column the compensation range falls under based on pay frequency in the Revised Withholding Tax Table:

Step 3: Calculate the prescribed withholding tax by establishing the predetermined tax and then the taxable excess amount. To do this, use the following formula:

Assume:

Predetermined Tax = A

Percentage = B

Threshold = C

Using the table, we learn that:

A = 0

B = 20%

C = 10,417

Calculation:

Prescribed Withholding Tax = A + [B of (Taxable Income – C)]

Or

Prescribed Withholding Tax = 0 + [20% of (15,500 – 10,417)]

Which comes down to:

Prescribed Withholding Tax = 1,016.60

Calculating for the withholding tax this way may be tedious, but in time, it could become second nature to the one handling the payroll calculations. However, it is important to note that there is still the possibility of getting human errors.

On-premise Payroll Software

In contrast to manual payroll process, ensuring that your on-premise or desktop application is compliant is an easier adjustment. It is a matter of ensuring that your software received the latest patch and if the update includes the changes brought by the 2018 TRAIN tax reforms.

For most cases, you would have to contact your supplier and directly ask them about the updates. Some suppliers would require for you to make a payment first for the patch or update before it gets implemented and be ready to be used.

Cloud-based Payroll Software

Much like the on-premise application, using a cloud-based payroll software is a matter getting the update. However, what sets this type of payroll processing tool apart from the on-premise payroll application is that the updates are usually already included with the service.

Reliable cloud-based applications like PhilPay, a payroll software distributed by JustPayroll, provide patches or updates for free without necessarily having to download heavy files. Announcements about changes and updates are sent out to clients, in which eliminates the need to be contacted.

To be safe, if you are using a different payroll software, it is best to contact your supplier to be sure that you are using the most compliant version.

Outsourced Payroll Services

When it comes to outsourced payroll services or having third-party provider, making sure that the output that you receive from them is compliant depends on the following factors:

- Are they certified payroll professional or CIPPs?

CIPPs are generally knowledgeable and capable of adapting to changes in the taxes. They stand by their work because their credibility depends on it.

- Are they aware of the 2018 TRAIN Tax Reform changes?

If your payroll service provider didn’t even hear about the recent tax reforms on the withholding tax, it is definitely a red flag.

- Are the tools and resources they are using updated?

In case that your payroll processing providers are performing their tasks manually, ask which version of the withholding tax table they are using. For those using payroll software, ask if they are up to date.

Compliancy is a must for every company or business in the Philippines. Besides from the fines that one receives for every payroll error, it has a detrimental effect that trickles all the way down to the company’s reputation, legal records, and employee attitude.

Keeping up with the changes in payroll, monitoring time and attendance, and calculating salaries can get complicated, but it doesn’t have to be… Afterall, it’s JustPayroll.ph.

We offer enterprise-grade payroll software, premium biometric devices, and superior outsourced payroll services.

Discover how easy payroll can be by choosing us, simply give us a call at +63 (02) 808-4707 or fill out the form below to get in touch with our payroll customer care.